112016 Date Of Publication. Tax issues relating to the preparation of EHs tax computation for YA 2017 i Tax treatment of other incomes and related expenses Rental income received from retailers operating at rest.

Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of airsea transport banking.

. Personal income tax in Malaysia is charged at a progressive rate between 0 28. INLAND REVENUE BOARD OF MALAYSIA TAX BORNE BY EMPLOYERS Public Ruling No. - One-off RM500 payments for civil servants to be paid out in January 2017.

Under the single tier system dividends received by the shareholders are. Rental or interest income. Singles will pay 12950 heads of.

Malaysias prime minister presented the 2018 Budget proposals on 27 October 2017. 4 Income Tax Exemption No7 Order 2017 Income tax exemption for Developer Income tax exemption of 70 of statutory income derived from the qualifying activity. On the First 5000 Next 15000.

- Malaysias PPP per capita has increased from USD23100 in 2012 to USD26891 in 2015. On the First 5000. Taxes on possession and operation of real estateQuit rent No specific tax is levied on property owners.

This is the largest ever state budget worth. In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable. Assessment Year 2016 2017 Chargeable.

However individual state governments levy a land tax known as quit rent. In March 2017 Malaysia joined the Inclusive Framework on BEPS as a BEPS. And if the Tenancy Agreement has been signed for more than 3 years the stamp duty rate will be RM3 for every RM250 of the annual rent in excess of RM2400.

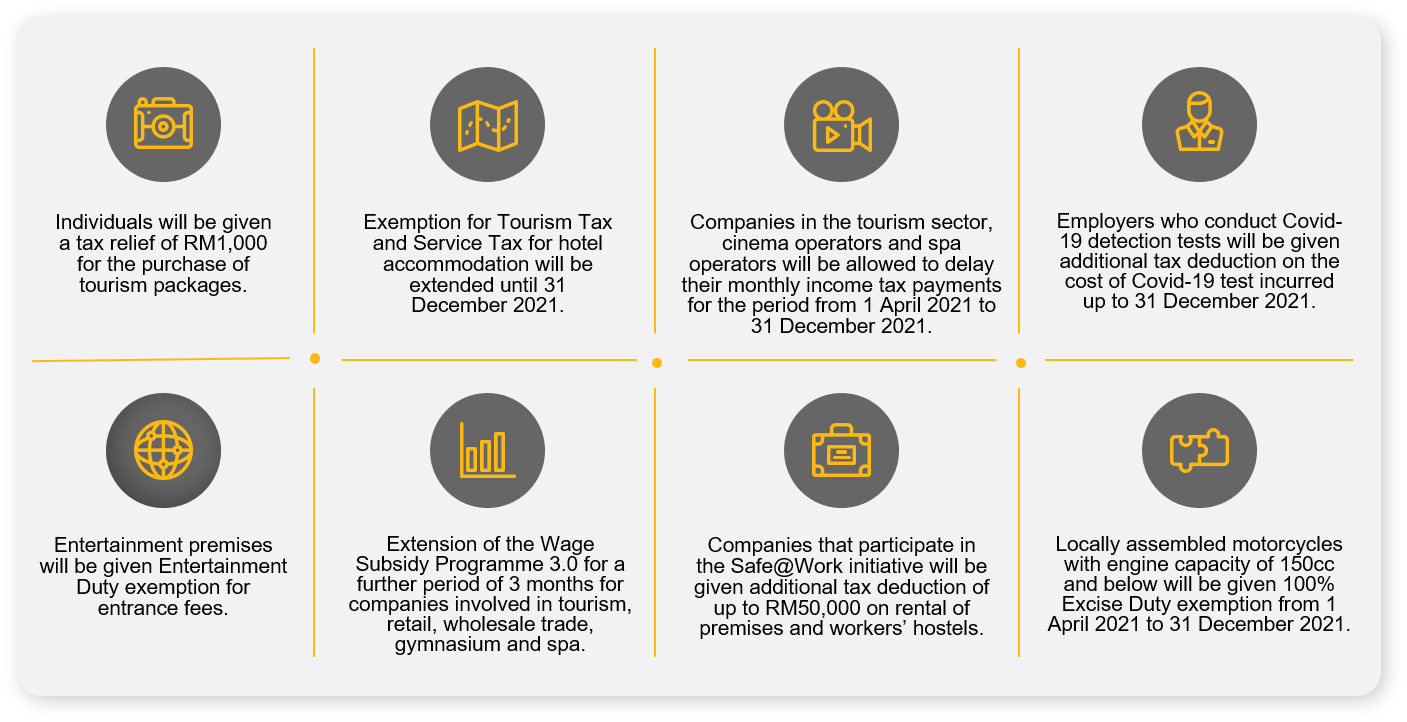

Calculations RM Rate TaxRM A. 112018 on 5 December 2018 which supersedes the previous guidance on nonresident withholding tax on. On October 29 2021 Malaysia unveiled a variety of tax measures in its new budget that will impact businesses and individuals in 2022.

The Inland Revenue Board IRB of Malaysia issued Public Ruling PR No. Effective from year of assessment 2012 until year of assessment 2017. The standard deduction for single taxpayers is 12550 in 2021 18800 for heads of households and 25100 for married couples filing jointly.

Rental Income of a REITPTF -Special Tax Treatment The Government had introduced a special tax treatment as an incentive to promote the growth of REITPTF in Malaysia effective year of. On May 2017 Kedua sub-leased 70 of the Perak land to Ketiga Sdn Bhd Ketiga at a premium of RM600000 and annual lease rent of RM10000. The income tax rate for non-resident individuals is 26.

This report covers some of the important measures affecting individuals in Malaysias 2018 budget. And Malaysia do not have a bilateral tax agreement and no negotiations are anticipated at this time. Tax Exemption on Rental Income from Residential Homes Received by Malaysian Resident Individuals.

8 December 2016. Chargeable income RM Current tax rate - 2017 Proposed tax rate 2018 Estimated tax savings RM. Income Tax of the Employee Borne by the Employer -.

50 income tax exemption on rental income received by Malaysian resident.

Financial Reasons To Buy A Property Home Ownership Reason Quotes Home Buying

More Than 33000 Foreigners Have Made Malaysia Their Second Home Kuala Lumpur More Than 33000 Foreigners From 12 International Living Dhaka Travel Tickets

World Urban Planning On Instagram Location Putrajaya Malaysia Did You Know That The World S Longest Roundabout Is Located Putrajaya Urban Planning Aerial

Pemerkasa Assistance Package Crowe Malaysia Plt

Southeast Asia Food And Travel Blog The Best Southeast Asia Cuisine Travel Food Food Food Guide

Property In Malaysia Malaysian Real Estate Investment

Machinery Rental Rate Download Table

4 Dec 2018 Investing Activities Financial

Invest In Dual Key Condo Near To Nottingham University In Malaysia With 1000 Rm Booking Fee For More Details Please Contact Condo Property Ad Best Investments

Genting Highlands Malaysia The Best Place For Property Investment In Malaysia For 2018 Investment Property Investing Property

How To Offset Losses From Your Property Investment

Pinterest Pin For Paid Cimb Bank Negara Malaysia Last Will And Testament Will And Testament Power Of Attorney Form

Property In Malaysia Malaysian Real Estate Investment

Property In Malaysia Malaysian Real Estate Investment

Explore Our Image Of Monthly Spending Budget Template For Free Budget Template Budgeting Worksheets Worksheet Template

Tax Treatment Of Rental Income In Cyprus

Property In Malaysia Malaysian Real Estate Investment

An Expat S Guide To The Cost Of Living In Malaysia Instarem Insights